Walmart Success Factors Pdf

Created Date: 6:05:22 PM. 'Is Wal-Mart Good for America?' Correspondent Hedrick Smith examines the power of Wal-Mart and other mass retailer chains, as the world's gateway to the American. Walmart Supercenters, branded as simply 'Walmart', are hypermarkets with sizes varying from 69,000 to 260,000 square feet (6,400 to 24,200 square metres). Free Essays on Wal Mart Key Success Factors. Case-Study Wal-Martstores in 2003. WalMart’s competitive advantage is a result of several key strategic choices. Walmart SWOT analysis 2016.

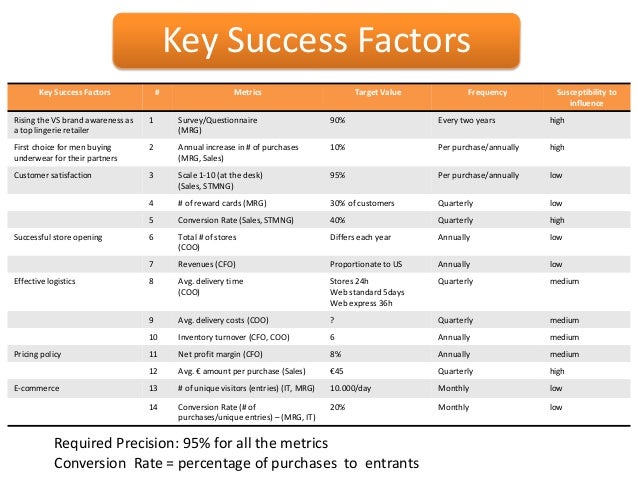

Extracts from this document. Introduction Key Success Factors (KSFs) Wal-Mart is in the supermarket industry, more specifically, discount retailing. From the industry analysis in Appendix 1, the most prominent characteristics of this industry include high degree of rivalry and high bargaining power of consumers which significantly impacts the firm's strategy and key success factors. From our analysis in Appendix 3 and 4, the following KSFs are most important: 1.

Maximize Revenue per Square Foot Retailers need to maximize the space utilization of their stores to gain competitive advantage. Merchandise is displayed and promoted with a view to meeting customer demands and maximizing profit. They are aware of store layout and warehouse construction costs to optimize utilization. Retailers must be cognizant of higher costs per square foot in urban areas and amend their offerings accordingly. Inventory Turnover and Management High inventory turnover and just in time inventory results in less dedicated store space and a larger merchandising display. Just in time inventory needs an efficient and innovative distribution system and close partnership with suppliers. This needs a state of the art information system to collect sales, inventory and customer information to share with key suppliers in order to improve forecasting, planning, replenishing and shipping applications.

Middle This enabled them to collect sales and inventory data, and use it to improve their operations. This helped lower Wal-Mart's operational expense ratio and gave them key competitive advantages. It is willing to spend a higher percentage of its operational expenses than competitors for IT solutions that can bring additional revenues in the future.

This is relatively difficult to replicate and sustainable when combined with advantages. Supplier Partnerships Wal-Mart shares its sales and operational data with its key suppliers for forecasting, planning, shipping and replenishment of merchandise. This helped Wal-Mart receive merchandise directly from the suppliers and enable cross docking to reduce supply chain, inventory and distribution costs; a great example of business process management innovation. Wal-Mart will allocate space to a supplier and have them explain how they will increase revenue for Wal-Mart. If the supplier can demonstrate this well they have the potential to obtain more store space allocated and ultimately create a win/win situation. This may be difficult to sustain as it is a standard practice now in the industry. Recommendations (Also see Appendix-6) Recommendations Reason Possible Tactics Re-evaluate asset base $83bn of assets in 2002.

Only $28bn is current. This is up nearly 50% in 5 years. Conclusion Appendix 5 Porter's Value Chain Model Appendix 6 Since Wal-Mart is already a cost leader it will have to excel in the areas of store factors, service excellence, product quality and trend leadership to create better customer value proposition for future growth. Store factors: Improve store look and feel. Studies have shown that customer's emotional responses and perceptions are influenced by the store's look and feel and have a pronounced effect on the time and money they spent in the store.

Customer Service Excellence: Help customers in their decision making by providing personalized information so they can make informed decisions. Guide customers to the merchandise and help them finding it either on the shelves or online. Help customers to understand the services being provided (checkout, returns) and solve any problems they are having so customer have a truly enjoyable shopping experience. Merchandise: Establish trend leadership by providing unique, first mover and quality merchandise. More product variety should be made available to customers by providing access to merchandise outside of inventory. Adapted for our report from 'Retailing in the 21st Century' by Manfred Krafft and Murali Mantrala 2006/2010???????? Wal-Mart Inc.

Walmart Success Factors

Entrance to a Walmart store in Pincourt, Canada. Walmart’s Five Forces analysis (Porter’s Model) on external factors in the retail industry environment gives insight on the company’s strategic direction. (Photo: Public Domain) Walmart’s strategic direction is based on the company’s responses to the Five Forces in its industry environment.

The firm has succeeded in achieving the leading position in the retail industry. Walmart now stands as the biggest retailer in the world. However, the external factors in the industry environment impose pressure that must be addressed. Walmart needs to develop strategies that address the bargaining power of buyers and suppliers. Effective strategies are also needed for the firm to withstand the threats of substitutes and new entrants. While Walmart has achieved success in this industry environment, this Porter’s Five Forces analysis reveals that the company must keep evolving to ensure long-term viability.

A Five Forces analysis of external factors in the industry environment of Walmart, based on Porter’s model, shows the implications of the competitive rivalry or intensity of competition, bargaining power of buyers or customers, bargaining power of suppliers, threat of substitutes or substitution, and the threat of new entrants. All of these factors impact Walmart’s success rate. Overview: Walmart’s Five Forces Analysis In summary, Walmart must focus on competitive rivalry and the threat of new entrants, based on this Porter’s Five Forces analysis of the retail industry environment.

Key Success Factors Of Walmart

These two external factors have the strongest force on Walmart’s business:. Strong competitive rivalry or competition. Weak bargaining power of buyers. Weak bargaining power of suppliers. Weak threat of substitutes or substitution.

Strong threat of new entrants. Walmart must create new strategies that develop and sustain the company’s competitive advantage in the long term. Emphasis on competitive advantage helps address concerns on competitive rivalry and the threat of new entrants. For example, Walmart can invest more in automation of internal processes in its supply chain. Improving human resource development can also boost the company’s competitive advantage.

Intensity of Competitive Rivalry (Competition) The intensity of competitive rivalry is strong in the retail industry. There are many firms of different sizes competing in this industry environment. The following external factors are the most significant for Walmart to consider with regard to competition:. Large number of firms in the retail market (strong force). Large variety of retail firms (strong force). High aggressiveness of retail firms (strong force) Walmart experiences the strong force of these three external factors in competitive rivalry in the retail industry environment. The company must remain aggressive to remain competitive.

While it is currently the industry leader, Walmart must keep its growth pace to remain in this position. Bargaining Power of Buyers Walmart faces the weak intensity of the bargaining power of buyers in the retail industry environment. The large population of buyers makes it difficult for them to impose significant pressure on retail firms. Walmart must address the following external factors concerning the bargaining power of buyers or customers:.

Large population of buyers (strong force). High diversity of buyers (weak force). Small size of individual purchases (weak force) The large population of buyers exerts a strong force on Walmart and the retail industry. However, the weak force of buyer diversity and the weak force of small individual purchases counteract such condition. In effect, the bargaining power of buyers is weak in influencing Walmart and other retail firms.

Bargaining Power of Suppliers The bargaining power of suppliers has weak intensity in the retail industry environment. There are many suppliers in the retail industry. Large firms like Walmart can easily affect these suppliers.

Based on this condition, Walmart and other retail firms must address the following factors contributing to the bargaining power of suppliers:. Large population of suppliers (strong force). Tough competition among suppliers (weak force). High availability of supply (weak force) The large population of suppliers has strong potential to impact firms like Walmart. However, there are many suppliers competing for the limited space in retail stores.

Also, the high availability of supply makes it difficult for suppliers to impact retail firms. Thus, Walmart and other retailers face the weak intensity/force of the bargaining power of suppliers. Threat of Substitutes or Substitution The threat of substitutes or substitution has weak intensity in affecting the retail industry environment. Walmart offers a wide variety of goods and some services that have a few or no substitutes.

Success Factor Login

The following external factors are the most significant on Walmart, concerning the threat of substitution:. Considerable availability of substitutes (moderate force).

Low variety of substitutes (weak force). Higher cost of substitutes (weak force) Some substitutes to Walmart’s goods are readily available. This is a significant consideration in the retailer’s strategic planning process. However, the external factor of the low variety of substitutes makes it difficult for consumers to move away from products available from retailers like Walmart. Also, some substitutes are more expensive than the low-cost goods available at Walmart stores. Thus, in the retail industry environment, the threat of substitutes or substitution has a weak intensity/force on Walmart. Threat of New Entrants (New Entry) Walmart and other retailers must address the strong-intensity threat of new entrants. New entry of retail firms is easily achieved even in the presence of giants like Walmart.

Small retailers can enter the market and compete on the basis of convenience, location, specialty, and other factors. This force is broken down into some of its component external factors, as follows:. Low cost of doing business (strong force). Moderate capital costs (strong force). Moderate cost of brand development (moderate force) It is costly to develop a new entrant’s brand. This condition exerts a moderate force on companies like Walmart. However, the cost of establishing a new retail firm and the cost of running it are low to moderate.

Thus, new entrants can keep operating and become potential threats to firms like Walmart. References. Dobbs, M. Guidelines for applying Porter’s five forces framework: a set of industry analysis templates. Competitiveness Review, 24(1), 32-45. Brea-Solis, H., Casadesus-Masanell, R., & Grifell-Tatje, E.

Harvard Business School. Soft press font. Gerdeman, D. Harvard Business School. R., & Spector, L. Mom-and-Pops or Big Box Stores: Some Evidence of WalMart Impact on Retail Trade.

Economic Development Quarterly, 26(4): 311-320. Matusitz, J., & Reyers, A. A Behemoth in India: Walmart and Glocalisation. South Asia Research, 30(3), 233-252. Meeks, M., & Chen, R. Can Walmart integrate values with value? Journal of Sustainable Development, 4(5), 62.

Department of Commerce (2017). Wal-Mart Stores, Inc. Wal-Mart Stores, Inc. Wal-Mart Stores, Inc. Zentes, J., Morschett, D., & Schramm-Klein, H.

Strategic retail management. Tags:, COPYRIGHT NOTICE: This article may not be reproduced, distributed, or mirrored without written permission from Panmore Institute and its author/s.

Copyright by Panmore Institute - All rights reserved. Small parts of this article may be quoted or paraphrased for research purposes, as long as the article is properly cited and referenced together with its URL/link.

Post navigation.

Menu

- Chicken Invaders 5 Trainer Pc Skyrim

- Azuquita Y Su Orquesta Melao Pura Salsa Rar

- Phoenix Drive Direct Game Rar File

- Goku Gekitouden English Patch

- Drive While You Pay Program In Memphis Tn

- Preheat Calculation Program

- Infinity Symbol Alt Code Vista

- Hootech Avi Mp4 Converter V5 5 With Key

- Red White Green Upon A Burning Body Rar

- Software Simulasi Mesin Cnc

- Buku Tentang Kedisiplinan

- Sabse Pehle Pakistan Book

- Cardioline Ar2100 View User Manual

- Autoresponder Madness 2.0

- Microsoft Office Starter For Windows Xp

- Javafx Webview Adobe Flash

- Remove Header Footer Pdf

- Winrar Password Remover Keygen Crack

- Restart Spooler Printer Vista

- Ripple Tool Final Cut Pro X

- Digicel Flex Card Number Generator Programs

- Ultimate Collector Edition Blu Ray

- Create A Batch File To Copy And Paste Specific Files

- Mirasys Dvms 5.11.6 (digital Video Monitoring System)